NZ Property Market Survey – August 2025

- Staircase Financial

- Aug 14, 2025

- 3 min read

The latest Staircase survey reveals a shifting sentiment among New Zealand property investors in 2025. While earlier in the year investor confidence was mixed, the recent drop in mortgage rates and a more investor-friendly regulatory environment are now fueling a more optimistic outlook.

Many seasoned and new investors are beginning to recognize the improving conditions and re-evaluate their property strategies accordingly.

Government regulation, once viewed as a significant hurdle, is undergoing reform aimed at supporting investment growth.

Combined with improved access to finance and stabilizing property prices, the market is presenting more opportunity than risk, especially for those prepared to act.

Auckland remains the top region for investor interest.

Encouragingly, more investors are starting to explore buying within the next year, seeing the market as primed for smart, well-timed purchases.

The most confident players in this environment continue to be existing property owners and high-income earners, but the improving landscape is creating space for newcomers to enter more confidently.

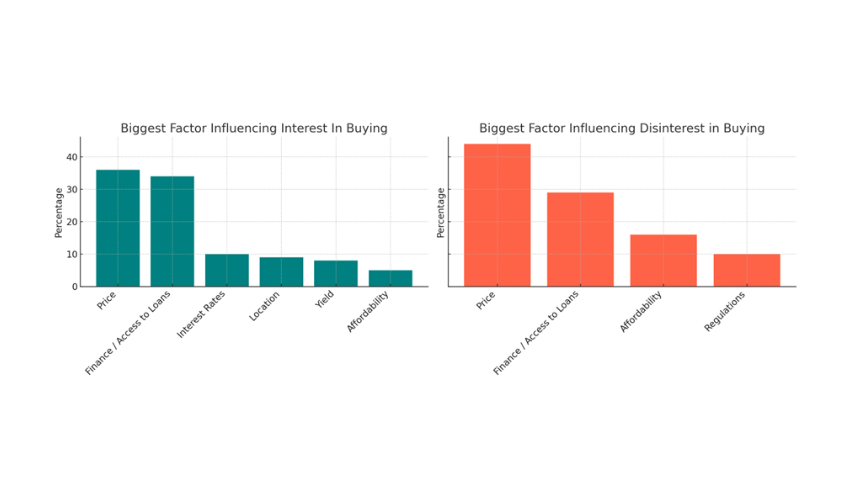

What Drives Property Investment – and What Holds People Back?

People who are interested in property investment tend to focus on five key factors:

Capital gains potential

Access to finance

Interest rate levels

Investment location

Cashflow/yield

Historically, affordability concerns and government policies have held some would-be investors back. However, with interest rates easing and recent regulatory adjustments making property investment more accessible, the environment is becoming far more favourable.

This turning point means that even those who were once hesitant due to economic constraints or unclear policy now have a stronger platform to consider entry.

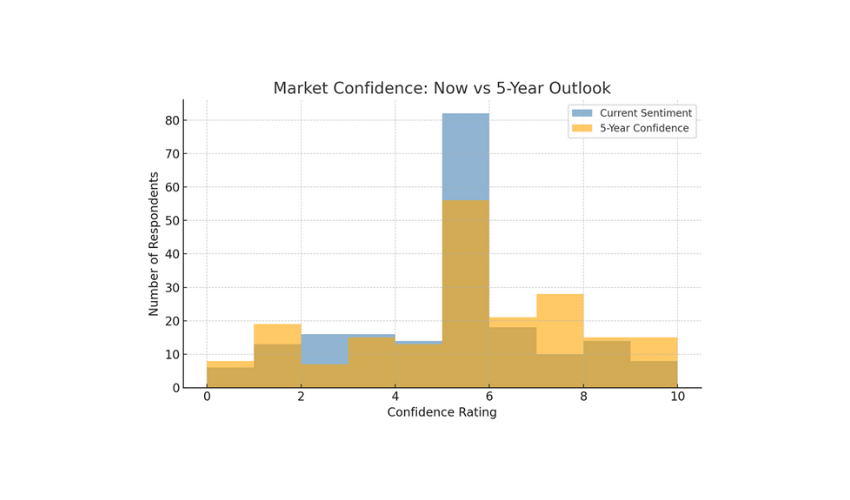

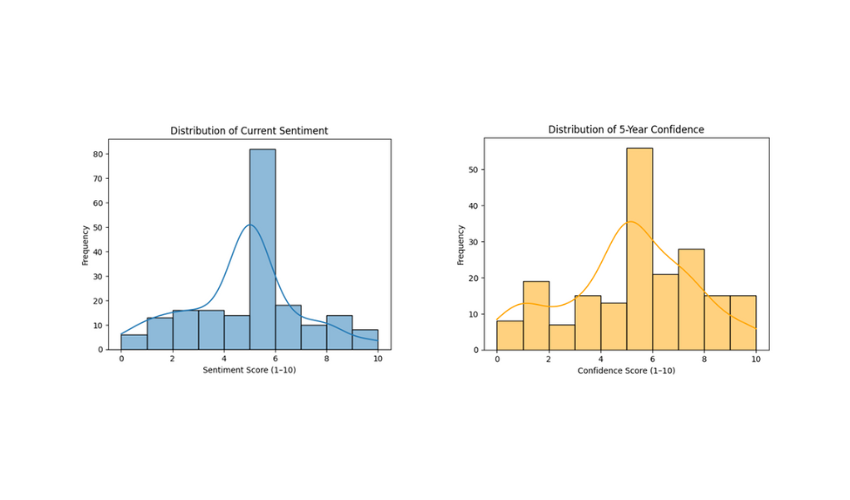

Market Sentiment & Long-Term Confidence

Short-term sentiment earlier in 2025 was mixed, but growing evidence of market recovery and financial stimulus is changing the narrative. Surveyed investors are showing stronger confidence in the market's five-year trajectory, driven by more stable lending conditions and a perception that prices have bottomed out.

Higher-income groups still lead in optimism, but we're seeing increased positivity across a wider demographic, indicating that opportunity perception is expanding.

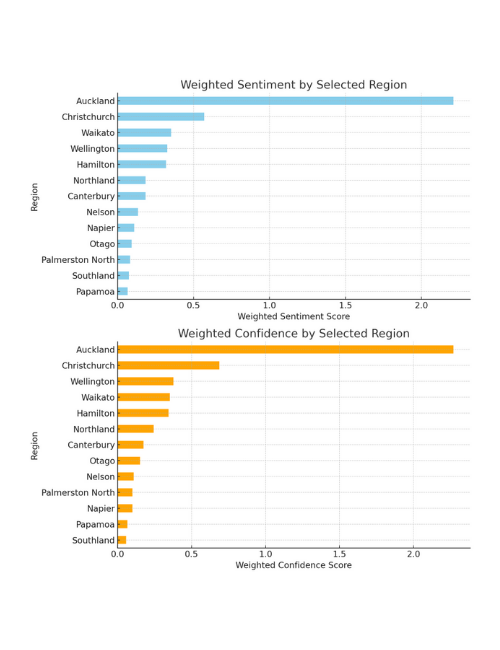

Regional Sentiment (Now) and Future Confidence

Investor interest is heavily concentrated in a few key regions. Auckland is the clear leader among all the regions. These top areas are seen as safer bets or likely to offer stronger growth potential.

Confidence is also higher in the top regions both now and looking forward, reflecting belief in their economic strength, infrastructure development, and ongoing demand.

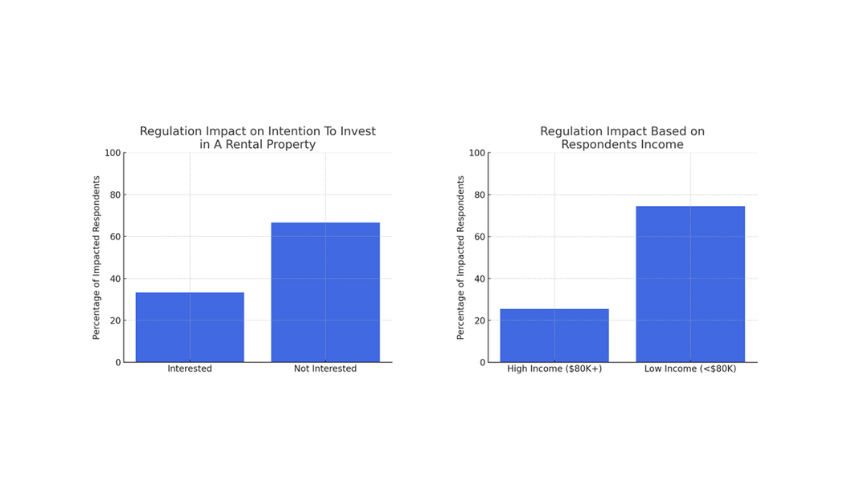

Impact Of Government Regulation

Government policy had previously discouraged some potential investors, but recent reforms are signaling a shift toward support rather than restriction. Tax changes and updated lending criteria are beginning to level the playing field, making it easier for both new and seasoned investors to access opportunities.

This changing environment underscores the importance of staying informed. Investors who adapt quickly to these positive developments are well-placed to benefit.

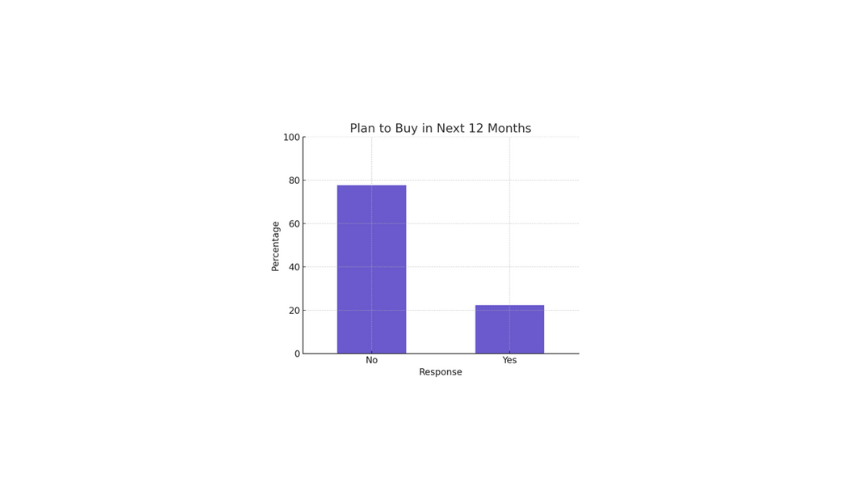

Buying Intentions

Although many respondents earlier signaled hesitation about buying in 2025, that trend is beginning to reverse. As confidence grows, so does buying interest, particularly among those who:

Earn over NZD $80K annually

Already own property

However, the improving conditions are also enabling more first-time investors to consider property seriously. Lower borrowing costs and policy changes are reducing barriers and creating an opening for broader participation.

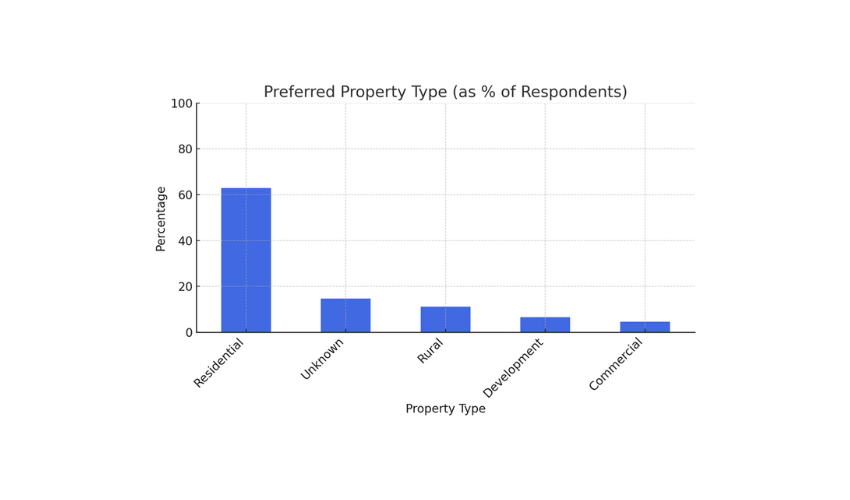

Preferred Type of Property To Invest In

Residential real estate continues to dominate investment choices, with standalone homes and townhouses remaining top picks. Newer investors, in particular, still view residential property as the most secure and familiar option.

Preferred Build Type of Property

Existing homes remain more popular than new builds, with many investors valuing their established locations, larger sections, and perceived character, however existing homes typically need more maintenance than new builds, have lower yields, and are often at a price point that is prohibitive.

Easing regulations around new builds may shift this trend in the coming months, presenting a window of opportunity for those considering modern, low-maintenance investments.

The NZ property market is entering a more investor-friendly phase, with lower mortgage rates, improved lending access, and regulatory reforms reshaping the investment landscape.

Whether you're a seasoned investor or just starting out, now is a strategic time to act.

Book a free chat with the team at Staircase and make your next property decision with confidence – the environment is more favourable than it’s been in years.

Comments